After adjustments, there is a need to prepare a trial balance again that ensures that all credits and debits are equal. Regardless of the scenario, an unadjusted trial balance displays all your credits and debits in a table. Once transactions are recorded in journals, they are also posted to the general ledger. A general ledger is a critical aspect of accounting as it serves as a master record of all financial transactions. Learn the eight steps in how to log in as an accountant process to complete your company’s bookkeeping tasks accurately and manage your finances better.

Step 2: Record Transactions in a Journal

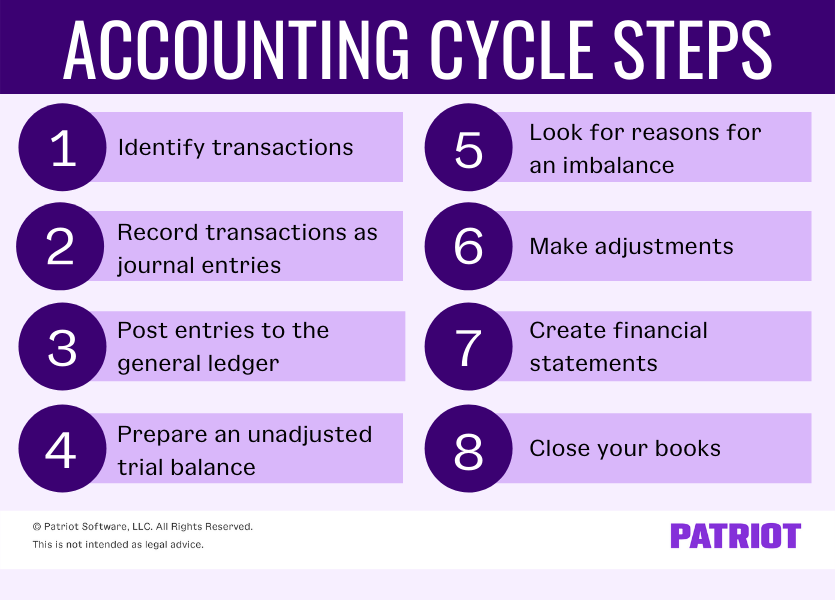

It involves eight steps that ensure the proper recording and reporting of financial transactions. Once a company’s books are closed and the accounting cycle for a period ends, it begins anew with the next accounting period and financial transactions. Cash accounting requires transactions to be recorded when cash is either received or paid.

Generation of financial statements

When the owner buy a personal car, it should also not be recorded as an asset of the business. Always watch for the separation of personal and business transactions. Usually, accountants are employed to manage and conduct the accounting tasks required by the accounting cycle.

Adjusting:

Bookkeeping focuses on recording and organizing financial data, including tasks, such as invoicing, billing, payroll and reconciling transactions. Accounting is the interpretation and presentation of that financial data, including aspects such as tax returns, auditing and analyzing performance. You can then show these financial statements to your lenders, creditors and investors to give them an overview of your company’s financial situation at the end of the fiscal year. A trial balance is an accounting document that shows the closing balances of all general ledger accounts.

Preparing an Adjusted Trial Balance

Accountants first need to gather information about business transactions, then record and collate them to come up with values to be reported (steps 1-6 in the accounting cycle). Financial information is ultimately presented in reports called financial statements (step 7). The accounting cycle, also commonly referred to as accounting process, is a series of procedures in the collection, processing, and communication of financial information.

- The main difference between the accounting cycle and the budget cycle is that the accounting cycle compiles and evaluates transactions after they have occurred.

- For example, Ray notices a large ending balance in prepaid rent when he knows he hasn’t yet paid rent for the coming month.

- The goal of closing the books is to return the balance of your temporary accounts to zero, meaning you need to identify your permanent vs. temporary accounts.

- This article explains what the accounting cycle is, the steps involved, and how following these steps can elevate your bookkeeping and financial reporting.

Step 4: Unadjusted Trial Balance

Closing entries offset all of the balances in your revenue and expense accounts. You offset the balances using something called “retained earnings.” Essentially, this is the profit or loss for the year that is “retained” in your business. Missing transaction adjustments help you account for the financial transactions you forgot about while bookkeeping—things like business purchases on your personal credit. There are lots of variations of the accounting cycle—especially between cash and accrual accounting types.

Obviously, business transactions occur and numerous journal entries are recording during one period. After you complete your financial statements, you can close the books. This means your books are up to date for the accounting period, and it signifies the start of the next accounting cycle. Once posted to the general ledger, you need to balance all of your business’s transactions. Do this at the end of the accounting period, which can be monthly, quarterly, or annually, depending on the company.

The ledger is a large, numbered list showing all your company’s transactions and how they affect each of your business’s individual accounts. However, you also need to capture expenses, which you can do by integrating your accounting software with your company’s bank account so that every payment will be charged automatically. When it’s the end of the quarter and it’s time to create a new budget for the next quarter, you need to look at historical data and predict your revenue and expenses for the next quarter.