Management must also consider the likelihood, magnitude and timing of the potential effects of any adverse conditions and events. But going concern should be considered at all stages of the audit, not just in terms of specific procedures, and the auditor is required to remain alert to events or conditions which may cast significant doubt on the company’s ability to continue as a going concern. The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has suffered recurring losses from operations, has a net capital deficiency, and has stated that substantial doubt exists about the company’s ability to continue as a going concern. Management’s evaluation of the events and conditions and management’s plans regarding these matters are also described in Note 2.

Step 2: Consider management’s plans if substantial doubt is raised

It could tell us whether the company has any cash problems in the next twelve months or not. If the cash flow forecasting indicates that the company does has any cash flow problems. We put environmental analysis in the first point because sometimes most of the management consider mainly the financial problems when performing going concern analysis. However, financial figures are the results of how the company is affected by non-financial figures, especially the environment. Assessing the going concern problems in the company is the main Role and Responsibility of the management of the company. The following are the key procedures that management should do to assess the going concern problems.

Sample Going Concern Disclosure – Substantial Doubt Alleviated

- When a business is started, it is assumed that it will not be dissolved in the near future.

- For example, a company may have a profitable track record or prior success at refinancing.

- Gibson is still considered a going concern, because it is not likely the fines and punishment will stop its operations.

- It follows that when this is not the case, a detailed analysis will be necessary, which likely includes robust cash flow forecasts and a review of existing and forthcoming financial obligations.

- The procedures are the key procedures and additional procedures might be required.

In this example it is clear that the going concern basis is inappropriate in the entity’s circumstances. The directors have no realistic alternative but to liquidate in order to raise funds to pay back the bank and the bank have already confirmed that they will commence legal proceedings to force the entity into selling off assets to raise finance to repay their borrowings. In the AA exam candidates may be required to describe the audit procedures that the auditor should perform in assessing whether or not a company is a going concern. In 2024, the Securities and Exchange Commission (SEC) issued its highly anticipated climate change disclosure rules. Our publication provides some key disclosure and reporting reminders for upcoming filings and summarizes the SEC’s rulemaking and other activities that affect financial reporting. The prime aspect of a business remains the capability and integrity of the management.

Services

The going concern concept means a business can ‘run profitable’ for an indefinite period until the concern is stopped due to bankruptcy and its assets are gone for liquidation. For example, when a business ceases trading and deviates from its principal business, the concern would likely stop delivering profits in the near-term future. Conversely, a healthy business shows revenue growth, profitability growth with unfavorable variance definition margin improvement, and growth in product sales. A firm’s inability to meet its obligations without substantial restructuring or selling of assets may also indicate it is not a going concern. If a company acquires assets during a time of restructuring, it may plan to resell them later. Consider how a single substantial lawsuit, default on a loan, or defective product can jeopardize the future of a company.

The business is a going concern because the closing down of a small portion of business does not impair the capacity of the enterprise to continue indefinitely in the future. Regardless of its weak financial standing, the National Company is still considered a going concern. The laws that bind corporations in all countries state that a company is presumed to have an uninterrupted existence with continuing activity until such time as it is legally liquidated. Here, it should also be noted that the assumption is not made that the business will be profitable throughout its existence.

How is going concern determined?

No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. In evaluating going concern, the auditor will consider whether necessary borrowing facilities are in place and in doing so will attempt to obtain confirmations from the company’s bankers. However, when the result of management assessment ongoing concern shows that the entity has no going concern problem, and auditors’ reviews also conclude the same thing while the actual is different. Auditors will use SAS 132, The Auditor’s Consideration of an Entity’s Ability to Continue as a Going Concern, to make going concern decisions. This SAS is effective for audits of financial statements for periods ending on or after December 15, 2017. SAS 132 amends SAS 126, The Auditor’s Consideration of an Entity’s Ability to Continue as a Going Concern.

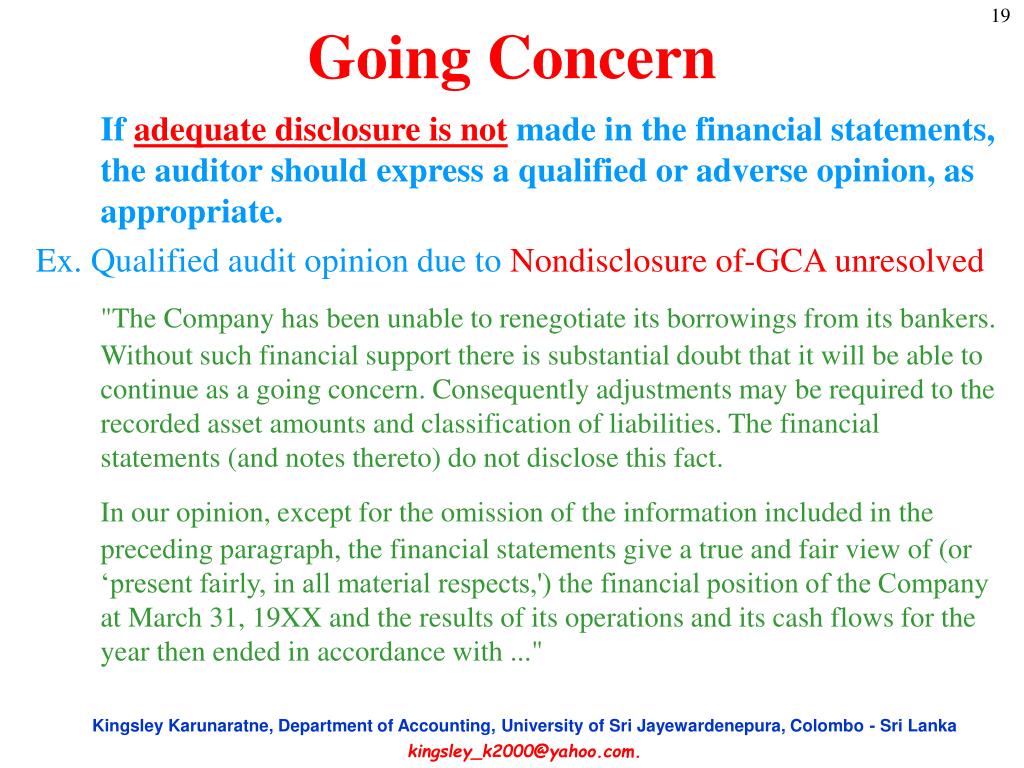

A qualified opinion can be a concern to investors, lenders and other stakeholders. Of SAS 132 states that an auditor should issue a qualified opinion or an adverse opinion, as appropriate, when going concern disclosures are not adequate. If the auditor concludes that the disclosures are inadequate, or if management have not made any disclosure at all and management refuse to remedy the situation, the opinion will be qualified or adverse. An important point to emphasise at the outset is that candidates are strongly advised not to use the ‘scattergun’ approach when it comes to deciding on the audit opinion to be expressed within the auditor’s report.

If the net income is zero or negative, it may be better for a company not to report any figures at all. This will help prevent the investors from getting pessimistic forecasts about future losses. Receive the latest financial reporting and accounting updates with our newsletters and more delivered to your inbox. KPMG handbooks that include discussion and analysis of significant issues for professionals in financial reporting. Although some sectors and jurisdictions are more affected than others, all companies need to consider the potential implications for the going concern assessment.

Are you preparing financial statements and wondering whether you need to include going concern disclosures? Or maybe you’re the auditor, and you’re wondering if a going concern paragraph should be added to the audit opinion. You’ve heard there are new requirements for both management and auditors, but you’re not sure what they are.