Blogs

Should your savings is born to own a recession in the next very long time, that will certainly destroy the job prospects of many freshly graduated people in Gen Z start to see operate in 2026. Seniors kept 51.8% away from family wealth after 2023, proof which they consistently hold generous financial and you may political electricity even while they era. Associated the newest economic success is actually a migration from young families on the metropolitan areas to the suburbs.

The good news is, you’ll find loads out of cashback searching apps you can pertain out of. Below are a few MySurvey and you may View Outpost for individuals who’lso are trying to find a real income perks. You’ll find loads of it is really good things one to somebody simply want to eliminate somehow.

Mega-moolah-play.com company site | Best Casinos playing Kid Bloomers Position the real deal Money

The woman work included working together that have television makers in the Tokyo to send mega-moolah-play.com company site quick development posts for FashionOne. The new totally free spins element might possibly be triggered if the people belongings the newest Spread symbols for the reels. When three or higher Scatters show up on the new reels then the fresh players will get 10 100 percent free spins instantly. Baby Bloomers are a slot machine game which has five reels collectively with ten pay traces.

What is the Riches Pit in the usa 2021?

Almost every other possessions belonging to seniors can be worth a maximum of $13.89 trillion, when you’re millennials own $2.23 trillion value of most other assets. The difference within the worth of the corporate equities and you may common fund shares is also greater among them generational groups; baby boomers individual equities and you will money so you can an entire worth of $17.79 trillion. Millennials, concurrently, only very own $0.72 trillion in the equities and fund, which means that middle-agers individual 96% far more within the finance and you can equities than just millennials.

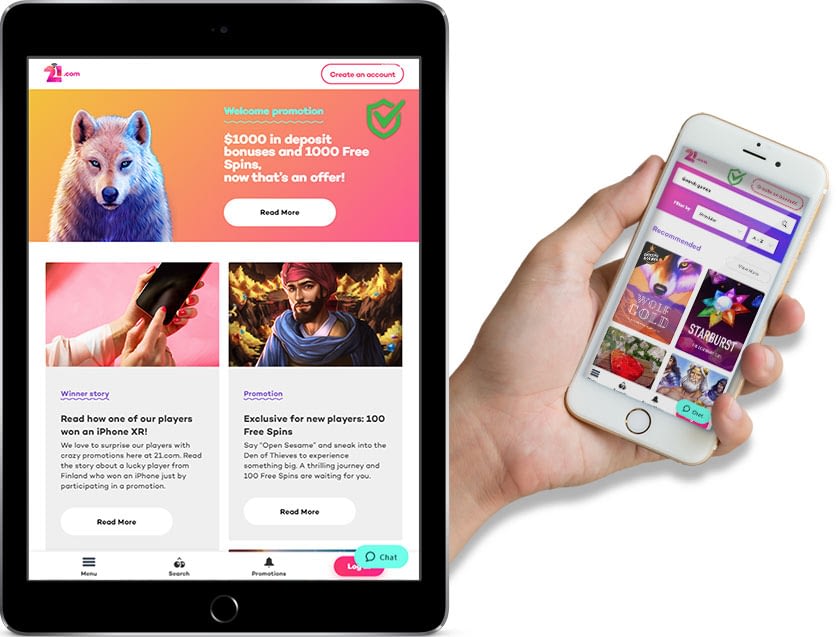

You don’t need a slot Town Casino login to view the fresh trial ability. You only need to come across it and click to the icon specifying the fresh demonstration online game element. All of the information found in the real currency choice is as well as offered from the trial, so it is a good choice to practice. Try out all of our 100 percent free-to-enjoy demonstration from Kid Bloomers on the internet position with no down load and you may no subscription necessary. Cost away from fixed-income ties rise and you may fall-in response to alterations in the pace paid back from the comparable ties.

Doing so won’t merely give them far more current earnings and you can more hours so you can plump right up the senior years accounts. It is going to reduce the time that they may must count on their discounts to support them. Instead, he’s being hit the toughest by unfortunate group of financial events recently. As they manage the fresh come out, they could merely desire to lower personal debt and accumulate enough wide range with time to possess retirement. On the earliest from millennials turning 40, economists are worried there isn’t enough time for most ones.

Comparable Ports

The brand new median conversion process rate at the outset of 2017 was just $313,a hundred, or perhaps the comparable now away from $402,100. When you’re a house within the Michigan or Kansas probably won’t ask you for much more than $150,one hundred thousand, would certainly be its happy to find something for less than $1 million inside the San Jose otherwise Atherton, California. At that time, they’d features shelled aside simply more than an enthusiastic rising cost of living-modified $52,100 to own tuition, fees, space and you will board from the mediocre four-12 months personal university otherwise $135,one hundred thousand to possess a private college or university. Inside the genuine cash, university fees can cost you rose that have a great compounded yearly growth rate (CAGR) of over 7% a-year away from slip out of 1973 from the slide of 1990. You might actually want to problem yourself as the people to find out how far money it can save you.

What is one of the ways middle-agers are ensuring the new lifetime of their income? Millennials are saddled that have disproportionately higher costs out of education loan loans and therefore are, an average of, marriage after in daily life, and therefore delaying homeownership. Also, they are facing higher book can cost you one to place the promise away from home ownership out-of-reach, according to the Metropolitan Institute’s declaration. To have Jessica Yourdon, a thirty-six-year-old social network coordinator based in San Antonio, marriage history slide produced the new hope of very first-time homeownership. Yet not, this really is rarely the way it is, the guy said, thus timeshares shouldn’t be considered comparable to holds, bonds otherwise a house. In addition to, he told you, clients often stop using timeshares as they get older, however, one doesn’t-stop restoration charges from increasing, and you will giving the secrets straight back have a tendency to produce simply cents for the dollars to the total price from ownership.

More youthful Years You’ll Catch-up so you can Boomers

Every piece of information on the internet site features a features just to entertain and you may inform folks. It’s the newest individuals’ duty to evaluate the local regulations just before playing on the internet. When you are Baby Bloomers is undoubtedly an on-line casino real money slot that delivers people a bona-fide possibility to score grand profits, moreover it have a demonstration solution. Choice that have demo currency and you can discuss the fresh technicians of this position host to know whether it fits to your what you need. The population study and you can wealth analysis on the quiet age group, seniors, Generation X and millennials depend on the brand new Census and the Federal Set aside. During the time the study are carried out, no analysis are designed for Age bracket Z. The net value for each and every age bracket in the particular moments is actually determined playing with an algorithm (web really worth/population for each age group classification).

But you to definitely will leave 43 percent who aren’t — along with millions of middle-class and you will reduced-money People in the us, as well as specific that have highest earnings, who you may tell you its offers inside twenty years of making works. Because the 76 million baby boomers near the avoid of their functioning life, the country is actually hurtling to your a pension overall economy. Many all U.S. assets — $41.8 trillion — are from a home, that’s not as well alarming offered simply how much assets beliefs have improved over the decades. Then started equities and common finance ($33.8 trillion), sturdy goods or other assets ($33.step three trillion) and you can pensions ($30.1 trillion).

What of a lot don’t think is how considerably the newest later years-money landscape has changed for the past couple of decades. The biggest differences is the change from laid out-benefit arrangements, or pensions, to laid out-share agreements, including 401(k)s and IRAs. Companies began to remove otherwise frost pensions while the market volatility are jeopardizing your retirement-finance investment. At the same time, 401(k)s were launched, providing specific pros; for starters, they were mobile phone from one job to some other. But the move from secured lifestyle income in order to individual financing profile shifted exposure and you may obligation out of businesses so you can pros — not just to help save to possess later years, but to expend those people discounts during the a renewable speed. They are both at risk of circumstantial problems and normal people misjudgment.